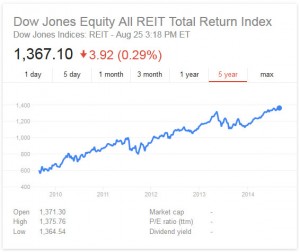

Investing in real estate, whether residential or commercial, has always been attractive for Real Estate Investment Trusts (REIT), which have outperformed other investment groups in the last few years. While many of the investment properties are traditional office, retail, residential and industrial, a growing subset is gaining attention: “specialty” spaces that include self-storage and data storage facilities.

Investing in real estate, whether residential or commercial, has always been attractive for Real Estate Investment Trusts (REIT), which have outperformed other investment groups in the last few years. While many of the investment properties are traditional office, retail, residential and industrial, a growing subset is gaining attention: “specialty” spaces that include self-storage and data storage facilities.

Specialty investment categories [List of Public REITs in the United States] include (but are not limited to):

- Timber

- Self-storage facilities

- Data storage facilities

- Entertainment spaces and structures such as megaplexes

- Health care facilities

- Farmland

- Campus housing (not considered the same as traditional multifamily spaces)

- Sustainable infrastructure

With investments in these non-mainstream entities proving to be solid, it’s likely more investors will start thinking “outside the office cubicle” and consider more non-traditional investment opportunities.

Recent Comments