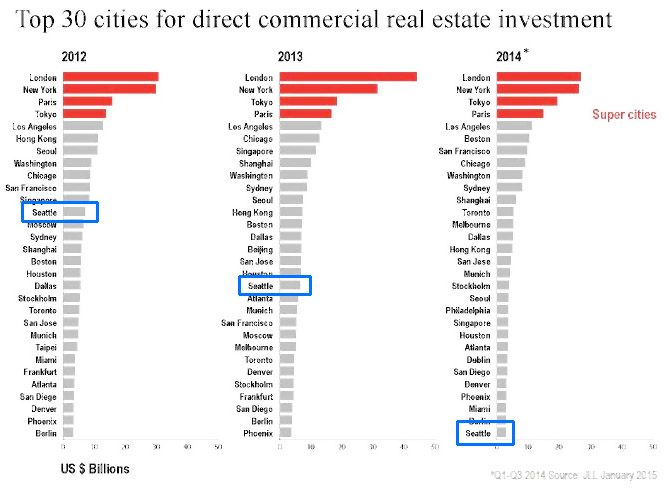

Jones Lang LaSalle is reporting that as real estate investment is reaching pre-Recession levels, 50% of it is concentrated in only 30 cities, worldwide. And, that impressive list includes Seattle, of course!

They report that real estate investment is expected to continue on the upswing to about $1 trillion by the year 2020, driven by emergence of new sources of capital, primarily in Asia and other emerging economies, increasing percentage of direct investment in real estate by institutional investors, and increasing trends of foreign investments from South Korea, China, Taiwan and Malaysia. (I earlier reported on how Chinese investors are creating a real estate boom in Seattle.)

Here’s JLL’s chart of the 30 leading cities for direct commercial real estate investment (I outlined Seattle in blue):

I’m a little surprised to see Seattle’s ranking dropping in the list over the past three years, but I think that’s merely due to the heavy rates of increase in CRE investment in many top cities.

I also think that we can see more CRE investment coming from institutional investors as they realize that commercial real estate is actually a fairly stable option, year over year, and they can cut out a lot of middleman costs, increasing their returns, through investing directly. JLL also alluded to the “regulatory environment” as one motivator to investors.

Recent Comments